You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All things STOCKS

- Thread starter bignewt

- Start date

Benzinga is getting their stories from VolNation..The drug is decreasing people's consumption.

There's a hedge idea. Weight loss drugs versus fast food.

Americans Swap $5 Burgers For $1,000 Weight Loss Drugs — Is Soda Getting Left Behind Too?

Americans Swap $5 Burgers For $1,000 Weight Loss Drugs — Is Soda Getting Left Behind Too?

BENZINGA 2:22 PM ET 4/30/2024

| Symbol | Last | Price Change |

|---|---|---|

| LLY | 777.89

| +40.69 (+5.5195%) |

| QUOTES AS OF 03:22:54 PM ET 04/30/2024 |

A trio of earnings reports Tuesday morning may have given us a glimpse into how Americans’ consumption habits are shifting. Eli Lilly(LLY) , which makes Mounjaro, one of the leading weight-loss drugs in the United States, beat EPS estimates and also raised its 2024 revenue guidance, sending the stock higher.

Meanwhile, both McDonald's and Coca-Cola each reported underwhelming quarters, sending their respective stocks lower. Weight-loss drugs, like Ozempic, Wegovy and Mounjaro, have swept through the country, quadrupling the number of prescriptions to more than 8 million last year. This means that almost 2.5% of all Americans were prescribed some form of weight-loss medication.

Read Also: Eli Lilly Increases FY24 Outlook, Joins Brinker International, Zebra Technologies, 3M And Other Big Stocks Moving Higher On Tuesday

Because of the drugs' impact on limiting appetite, it's safe to assume that some people may eat fewer burgers and fries from McDonald's and other fast-food chains. Undergoing weight-loss treatment through expensive medication may also incentivize patients to cut out unnecessary calories like the ones found in soda.

One market expert, Chris Versace, host of the Thematic Signals podcast, said it's still too early to determine whether weight-loss drugs directly impact McDonald's sales volume. But, Versace points out that markets tend to be a ‘forward-looking animal'. If the adoption of weight-loss drugs continues to grow, the impact on ‘junk food' stocks like McDonald's and Coca-Cola could be more significant.

"So it’s hard to measure, right? So far we haven’t really seen any results. But as we know, the market tends to be a forward-looking animal," Versace said, as reported by TheStreet. "So it’s saying to itself, geez, what could this be possibly in 12, 18, 24 months? And the issue is that when we see forecasts and expectations like this, they tend to get ahead of themselves, and I think that’s exactly what’s happening here again."

The Bottom Line: Weight-loss drugs appear to be continuing to trend upward, while McDonald's and Coca-Cola are lacking growth. Other issues, like inflation, could also be negatively effecting sales from fast-food companies with lower-income customers most impacted.

Now Read: Breaking: DEA Reportedly Moves To Reschedule Cannabis, Stocks Rise Sharply On The News

Image generated using artificial intelligence via Midjourney.

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 3,969

- Likes

- 6,814

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

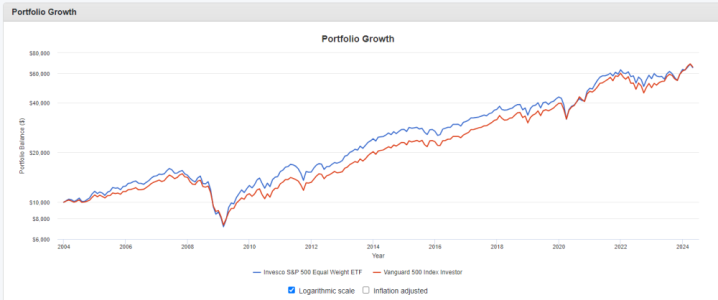

Thoughts on equal weight ETFs?

They might make sense right now. Take the Mag 7 out of S&P and QQQ returns over the last year or 2 and those averages are far off of their results. There seemed to be a rotation into other names before the pull back over the last couple of weeks. The M7 seems tired. Although GOOGL did pop 10% one day last week iirc.

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 3,969

- Likes

- 6,814

Keep in mind here the "who cares" test. If you decide to hold X% in passive USA only stock funds, then that's a big decision and it matters a ton, at least to people who aren't medical doctors. If you decide you want to use equal weight instead of cap weight, that's a very uninteresting question. On a scale of 1 to 10 it's a 1. Deciding to not spend all your money and invest is a 10. Deciding to passively invest in USA stocks is a 9.9.Thoughts on equal weight ETFs?

Last edited:

Not a fan.Thoughts on equal weight ETFs?

Get ballsy and pick something.

It can either be something you really really like. Or, it can be something you extra ordinarily dislike. Eliminate / Add based off that opinion.

For me, equal weight is only for someone who chooses to not pay any attention to market at all.

With that disclaimer, I casually follow along. And, the S&P 500 has probably beat me four of last five years...lol!

Gamblers anonymous!Not a fan.

Get ballsy and pick something.

It can either be something you really really like. Or, it can be something you extra ordinarily dislike. Eliminate / Add based off that opinion.

For me, equal weight is only for someone who chooses to not pay any attention to market at all.

With that disclaimer, I casually follow along. And, the S&P 500 has probably beat me four of last five years...lol!

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

Yes!isn’t the math on them that they won’t let the winners run and they throw more capital at the underperforming equities?

They are forever dumping medicine & technology to buy more energy / commercial real estate.

Playing small ball....which is ok.

I try to swing like the Tony V lead baseball team. Somedays, I lose to Lipscomb.

Gambler's Anonymous sums it up well.

Velo Vol

Internets Expert

- Joined

- Aug 19, 2009

- Messages

- 36,661

- Likes

- 17,060

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 3,969

- Likes

- 6,814

^^^^ I am not too concerned about either of those two people. Investing in starbucks would not be my choice. I'll drink a regular pike's place from there. I don't mind it. but to project growth from here, no. Not for me. Listening to Cramer also has not been a lucrative choice for folks, so they say. I admit I don't keep track of him like some have.

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

^^^^ I am not too concerned about either of those two people. Investing in starbucks would not be my choice. I'll drink a regular pike's place from there. I don't mind it. but to project growth from here, no. Not for me. Listening to Cramer also has not been a lucrative choice for folks, so they say. I admit I don't keep track of him like some have.

The SJIM and LJIM Cramer short and long ETFs were closed in January after 11 months.

Carp

Well-Known Member

- Joined

- Feb 7, 2009

- Messages

- 4,269

- Likes

- 5,233

Haven't posted in here in a while. Took a break from investing and let things cook. Didn't make much, but didn't lose any.

Took my first new swing position in a while with LOT (EV division of Lotus) since the EV market has been heating up and it looked very under priced. Sold today and pulled a cool 25% profit in about 2 weeks.

Took my first new swing position in a while with LOT (EV division of Lotus) since the EV market has been heating up and it looked very under priced. Sold today and pulled a cool 25% profit in about 2 weeks.

Last edited:

Outstanding work! RIVN seems to have some potential.Haven't posted in here in a while. Took a break from investing and let things cook. Didn't much, but lose any.

Took my first new swing position in a while with LOT (EV division of Lotus) since the EV market has been heating up and it looked very under priced. Sold today and pulled a cool 25% profit in about 2 weeks.

Auto sector too difficult for me to understand.

USA has trouble w/manufacturing.

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 3,969

- Likes

- 6,814

Velo Vol

Internets Expert

- Joined

- Aug 19, 2009

- Messages

- 36,661

- Likes

- 17,060

My understanding is they gave bad guidance.Thank you. I’ll add more. I swear, investors beat this thing up even when it beats estimates. This will rebound nicely by end of year.

View attachment 639447

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

As far as car/truck retailers, IMO CarMax has a terrific business model while Carvana is smoke and mirrors and is controlled by a shady family.

Carvana shareholders are benefiting from the mother of all short squeezes (at least since meme stocks).

A couple of years ago I looked into Carvana and iirc the market cap divided by the number of physical locations was $1 billion. That’s some fancy elevators.

Carvana shareholders are benefiting from the mother of all short squeezes (at least since meme stocks).

A couple of years ago I looked into Carvana and iirc the market cap divided by the number of physical locations was $1 billion. That’s some fancy elevators.

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 44,779

- Likes

- 44,252

RACE has surprised me. I think it’s up about 10x in 10 years. They benefit from a small production run of about 15,000 vehicles annually with a multi-year waiting list. 3,000 billionaires got to buy something with their trillions.

P/E is around 50x. I’d guess it’s more like a sideways stock going forward. But looking at MSTR/Bitcoin and TSLA and many other examples, stock buyers can keep specific investments irrationally valued for long periods of time.

P/E is around 50x. I’d guess it’s more like a sideways stock going forward. But looking at MSTR/Bitcoin and TSLA and many other examples, stock buyers can keep specific investments irrationally valued for long periods of time.